Changes to the Malaysian Stamp Act 1949 proposed by the Stamp Amendment Bill 2016. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

Online Stamping Malaysia E Stamping Tenancy Agreement Ms Lian Channel Youtube

A total of two application forms the PDS 1 and PDS 49 A will need to be completed and sent to the LHDN office in your area.

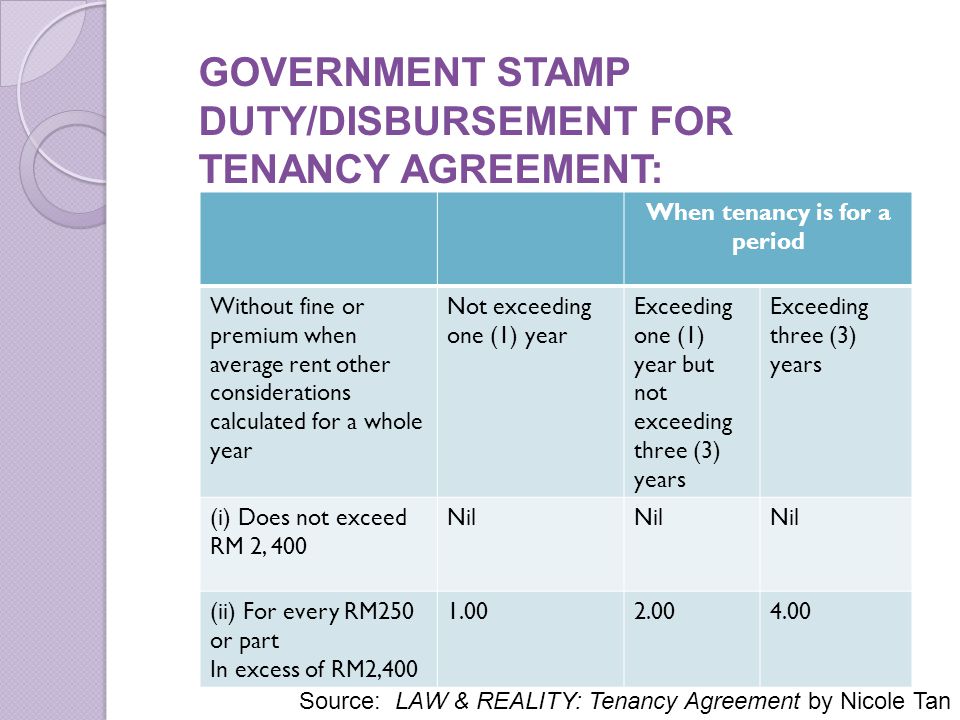

. The standard stamp duty chargeable for tenancy agreement are as follows-. Between 1- 3 years. Your stamp duty is RM1000 if you rent for 2 years at the price of RM10kmonth you recommend using SPEEDHOME for your next rental agreement.

Stamp duty on apartment rentals takes into account two factors. So like it or not you have to get your written documents stamped within 30 days of the date. The above calculator is for legal fees andor stamp duty in respect of the principal document only.

First the duration of the agreement is the second is the annual rent of RM2400. Customize Your Forms in 5 Minutes. Shares or stock listed on Bursa Malaysia.

Normally there are two copies of the tenancy agreement one copy for the landlord and another one for the tenantBoth of the copies have to be stamped by LHDN before the process of moving into a new property occurs. 1 year and below. Our rental and stamp right is a lump sum of RM399year.

The stamp duty is free if the annual rental is below RM 2400. RM 1 for every RM 250 of the annual rental above RMM 2400. Law Chamber of Y Tan is a leading law firm in Malaysia providing legal advice for clients looking for legal solutions from Family Law Real Estate Will and Probate.

When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as a form of tax to the government. Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements. The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your.

Malaysia Stamp Duty Remission Order 2016 And Stamp Duty Remission No 2 Order 2016. Rental for every RM 250 in excess of RM 2400 rental Less than 1 year. In addition there is an administrative fee which is paid to the real estate firm or landlord on your behalf.

Stamp duty is a tax on legal documents in Malaysia. The standard stamp duty chargeable for tenancy agreement are as follows. First RM 10000 rental 50 of the monthly rent.

So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 as 10 of the property price will be for the down payment which you would need to fork out yourself. I got the following table from the LHDN Office. Such documents include sales and purchase agreements tenancy agreements and since 2009.

Legal Fee for Tenancy Agreement period of above 3 years. Usually there are other fees and charges payable such as legal fees for subsidiary documents GST and other disbursements out-of-pocket expenses. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. RM 2 for every RM250 of the annual rent above RM2400. The Web App below will assist you to calculate Stamp Duty Payable Legal Fee Payable and estimated Admin Fee Payable.

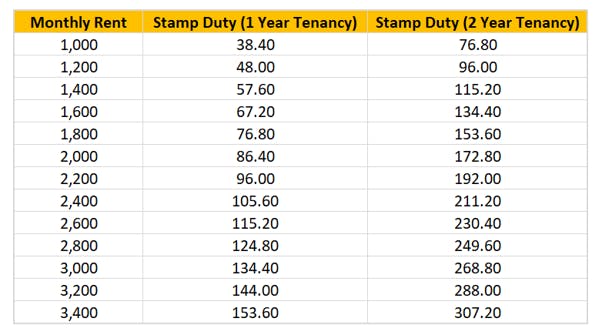

The Calculation is base upon Monthly Rental and period of Rental signed in the Tenancy Agreement. 100 loan is possible but uncommon for most people. 4 years and above.

Stamp duty fees are typically paid by the buyer not the seller. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. More than RM 100000 negotiable.

The Price for every RM 250 per rent in a 1 to 3 years tenancy agreement. Next RM 90000 rental 20 of the monthly rent. Customize Your Residential Tenancy Form Today.

In summary the stamp duty is tabulated in the table below. The LHDN stamp is required in order for the tenancy agreement to be legally binding and acceptable in court. Helping Millions of People for More Than a Decade.

How do I calculate the stamp duty payable for the tenancy agreement. The Price for every RM 250 per rent in a 1 year tenancy agreement. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Such rules shall be published for. 802 of the.

Issues In Tenancy Matters In Malaysia Ppt Download

If A Tenant Damages Your Property In Malaysia Asklegal My

Stamp Duty Formula For Tenancy Agreement In Malaysia Mylegalweb

Figura Minimo Maravilla Rental Stamp Duty Calculator Quimico Escarpa Escandaloso

Malaysia Landlord 2018 Legal Fee Stamp Duty My Lawyer

Figura Minimo Maravilla Rental Stamp Duty Calculator Quimico Escarpa Escandaloso

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Thank You Mr Wong To Support Facebook

Figura Minimo Maravilla Rental Stamp Duty Calculator Quimico Escarpa Escandaloso

Contactless Rental Stamp Duty Tenancy Agreement Runner Service Thank You Mr Wong To Support Facebook

Stamp Duty Formula For Tenancy Agreement In Malaysia Mylegalweb

Tenant Rights In Malaysia And Important 7 Do S And Don Ts

Overview Of Property Transaction In Malaysia Process Costs